Get a Fleet Insurance quote from our Massachusetts specialists

Jump Suit Group Insurance

Running a business that relies on a fleet of vehicles can be challenging, especially in a bustling state like New Jersey. Connor-McClure Insurance Services is here to help you navigate the complexities of protecting your commercial vehicles with customized fleet insurance solutions.

What Is Commercial Fleet Insurance?

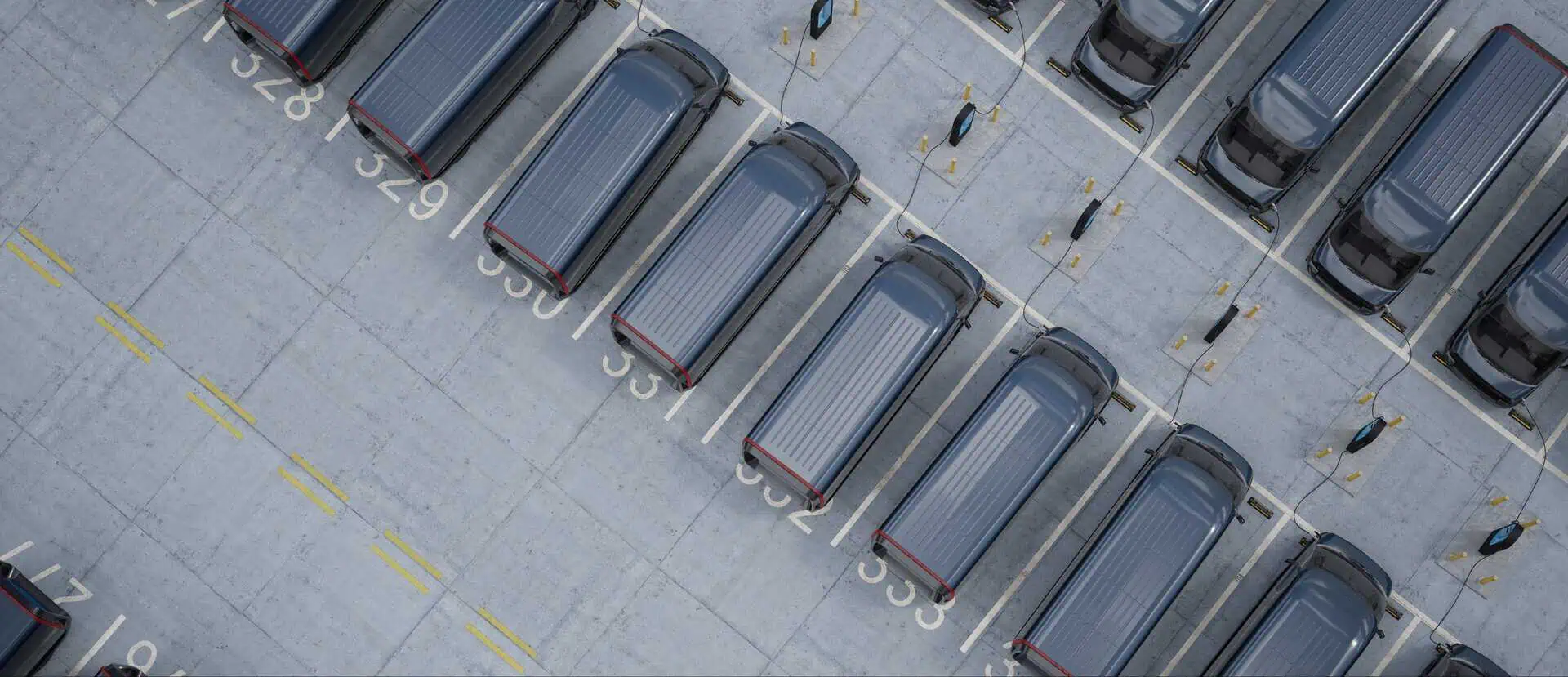

Commercial fleet insurance is a specialized commercial policy designed to cover multiple business vehicles under a single insurance plan. Instead of managing separate policies for each vehicle, fleet insurance streamlines coverage, potentially saving time and money while ensuring consistency in protection.

Whether your fleet consists of delivery vans, trucks, or company cars, commercial fleet insurance may offer liability coverage, physical damage protection, and more. However, the specific terms and coverage options vary depending on your business needs and the insurer’s offerings.

Why Is Fleet Insurance Important for Businesses in New Jersey?

In New Jersey, businesses face unique challenges due to the state’s high traffic density, busy urban centers, and diverse industries. Fleet insurance can provide essential protection for:

- Accidents that may occur in congested areas.

- Damage caused by harsh weather conditions, common in the region.

- Liability claims arising from vehicle operations.

Without proper insurance, a single accident could lead to financial strain. Having fleet insurance tailored to your business can help mitigate these risks.

How Do I Get Started with Fleet Insurance for My New Jersey Business?

Getting started is easy. At Jump Suit Group Insurance, we’ll guide you through the process:

- Schedule a Consultation: Contact us to discuss your fleet and coverage needs.

- Receive a Customized Quote: We’ll provide tailored options based on your business operations.

- Secure Your Coverage: Once you’ve selected a policy, we’ll handle the paperwork and ensure your fleet is protected.

Reach out to us today to begin the journey toward comprehensive and reliable fleet insurance.

Get a Quote

Share your details with us, and our team of friendly agents will be in touch with you soon!